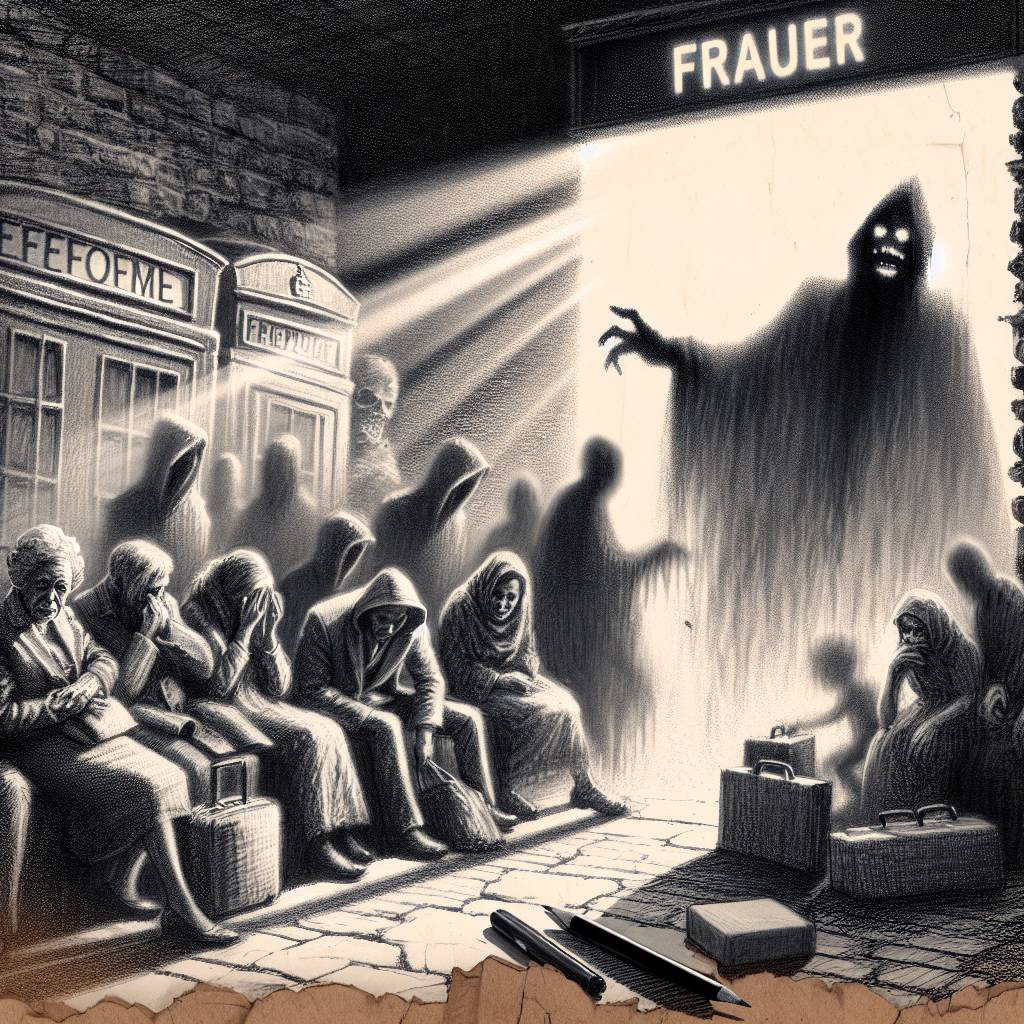

Fraud Frenzy: UK Consumers Hit Harder in 2025’s First Half as Scams Surge

UK consumers faced a steep fraud hill in the first half of 2025, with losses up 3% and cases surging 17%. Romance fraud soared 35%, proving love hurts, especially your wallet. Unauthorized fraud also climbed, with card fraud cases reaching new heights. It seems criminals are working overtime while consumers are left holding the (empty) bag.

Hot Take:

Who knew that in 2025, crooks would be the ones hitting the gym—bulking up their fraud muscles to lift more cash from our wallets? Clearly, the romance is dead—unless it’s between scammers and your bank account. The only thing growing faster than fraud cases is the queue for avocado toast at brunch! Someone get these tech giants some spinach, because it looks like their security controls need a little Popeye-strengthening.

Key Points:

- Fraud losses in H1 2025 rose by 3%, totaling £629m, with 2.1 million cases reported.

- Authorized Push Payment (APP) fraud saw a 12% increase in losses, driven by investment scams.

- Unauthorized fraud cases surged, particularly in card fraud, which increased 5% annually.

- Despite new bank reimbursement regulations, criminals are still finding ways to exploit digital ecosystems.

- Social engineering and compromised one-time passcodes (OTPs) are significant enablers of fraud.